Rada refuses to raise military tax for military

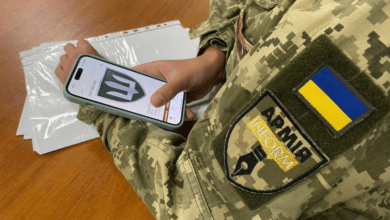

Military servicemen of the Armed Forces of Ukraine and other security forces will not receive an increase in the military levy — the Council approved an amendment according to which this levy will remain at the level of 1.5%. About this reported people’s deputy Yaroslav Zheleznyak after consideration of the relevant draft law.

The amendment applies not only to servicemen of the Armed Forces, but also to other law enforcement agencies, including the Security Service of Ukraine (SBU), the Foreign Intelligence Service, the National Guard, the State Border Service, the State Security Administration, the State Special Communications Service, and the State Special Transport Service. For all these categories, the military levy will remain at the level of 1.5%.

At the same time, the Verkhovna Rada rejected another amendment, which provided for an increase in military duty to 5% for all citizens. People’s deputy Oleksiy Goncharenko initially reported this, but later clarified that this increase would not apply to the military.

In the conditions of war and the need to increase defense expenditures, the government of Ukraine initiated changes to the state budget for 2024, increasing defense expenditures by 495.3 billion hryvnias. These costs will be covered by increasing state budget revenues, in particular by increasing taxes, because Ukraine’s international partners do not finance military expenditures. At the same time, the Ministry of Finance of Ukraine emphasizes that tax revenues and domestic borrowing are a key source of defense financing.

In order to cover growing defense costs, it is planned to increase state budget revenues by more than 214 billion hryvnias, as well as to borrow more than 160 billion hryvnias on the domestic market. In addition, the government plans to cut over 60 billion hryvnias from the cost of servicing the public debt.

These changes also include initiatives to the Tax Code, which the government submitted to the parliament. The draft law envisages revision of tax norms to ensure additional financial revenues to the budget, necessary to support the defense needs of the country.