New US tariffs: what Trump’s decision means for Ukraine in the changing world of global trade

The decision of the Donald Trump administration to introduce a single customs tariff on imports into the US actually means a sharp tightening of the trade policy of one of the world’s most influential economies. Against the background of growing political turbulence, resurgence of global inflation, conflicts over access to markets and supply chains, the United States’ move to raise tariffs is not just an economic measure. This is a signal to revise the very logic of globalized trade, in which the established rules of the WTO era no longer apply. For Ukraine, this issue is not limited to export statistics, it affects opportunities to expand market presence, review trade strategy, investment conditions and the ability to adapt to a new reality in which preferences, alliances and flexibility become more important than general rules.

Yaroslav Zheleznyak on new tariffs: how it affects Ukraine

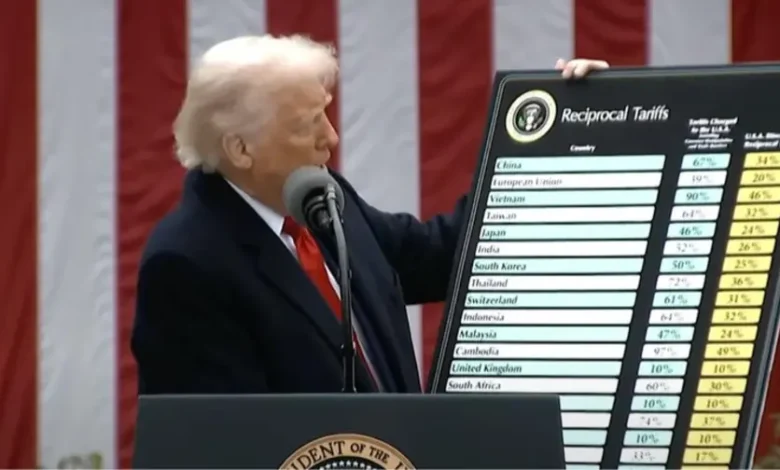

On April 2, 2024, US President Donald Trump signed a decree to introduce a basic import duty of 10% for most countries of the world. At the same time, individual reverse tariffs have been established for those states that have a significant trade surplus in relations with the USA. These tariffs come into effect on April 9. The list of countries with the highest rates includes Vietnam (46%), China (34%), the European Union (20%), Taiwan, South Korea, Japan, and India. Ukraine, despite the low volume of exports to the USA, also made it to the list — with the lowest possible tariff of 10%.

People’s Deputy of Ukraine Yaroslav Zheleznyak, considers, that these restrictions are not critical for the Ukrainian economy: annual exports to the US amount to less than 1 billion dollars, which is approximately 2% of the total volume. The basis of supplies is metal products, which have already been subject to a 25% customs duty since March, as well as agricultural products, for which increased tariffs were predicted even earlier. At the same time, imports from the USA to Ukraine are almost five times larger, which explains the softer conditions for Kyiv. This, according to the deputy, creates an opportunity for Ukraine to intensify negotiations with other countries that may lose part of their markets due to the trade response of the United States.

“Brief and to the point:

1) Not much. Our exports there do not even reach one billion and 2% of everything we export somewhere.

2) 🇺🇸USA imports to us almost 3 billion, in general 5 times more. Therefore, we received a “light” tariff of only 10%.

3) Most of all, we transported metallurgical products, but there is already a 25% tariff on steel and aluminum for us since March.

More pipes, but there is already a tariff + anti-dumping.

4) About a third of exports are agricultural and food products. But there, too, the tariff was already expected from April.

Well, that’s not a disaster, especially when conditions are worse for others (our tariff is 10%, not 54% like in China).

Here is a small nuance, now the EU, China, India and others will also introduce tariffs on products from the USA in response…. And here a window of opportunity opens for us to enter their market)” – Zheleznyak wrote in Telegram.

Danylo Hetmantsev on the global context

At first glance, the introduction of tariffs in the US does not have an immediate impact on the Ukrainian economy. But in the long run, it creates a much wider effect. Chairman of the Parliamentary Finance Committee, Danylo Hetmantsev emphasizes, that trade wars never pass without a trace — they can disrupt global supply chains, slow the flow of capital, cause prices to rise and put pressure on the economic recovery of vulnerable countries. According to him, the world is entering a phase where collective institutions – such as the WTO – are losing influence, and economic policy is increasingly taking on the characteristics of unilateral decisions that trigger chain reactions in response.

Hetmantsev also warns of a possible increase in global inflation, a drop in the pace of development, restructuring of production chains and a decrease in social welfare — all of this will primarily affect countries that do not have sufficient resources for rapid adaptation. For Ukraine, the threat lies not so much in the tariffs themselves, but in a change in the rules of the game: a slowdown in international trade, a decrease in demand for raw materials, a reorientation of investors to markets with greater predictability.

“It can be stated that:

- Decades of rules-based global trade (WTO) have vanished. The risks of a massive trade war lie ahead – the world’s largest economies will certainly not sit idly by and leave a unilateral increase in US tariffs (however justified) unanswered.

- Large global corporations will try to circumvent tariffs by transferring production to the USA (where they count on it), many countries will try to negotiate with the USA unilaterally by reducing tariffs, but this is a very risky strategy for the USA. It may not work, deepening the country’s isolation on the continent.

- A direct and obvious consequence is an increase in prices and global inflation, a slowdown in world trade, disruptions in global chains of added value and, as a result, a decrease in the growth rate of the global economy. All these conclusions are valid both for the world economy and for individual countries, which will be faced with growing inflation, falling social welfare and falling rates of economic development.

- Ukraine is not included in the list of countries to which the increased individual return tariff applies, i.e. the basic duty of 10% will apply. It will be interesting to know the position of the Ministry of Economy regarding countermeasures, if any. In theory, this step will lead to an increase in the price of imports, a rise in prices, an increase in the trade deficit and will have a negative impact on economic recovery.

How it will turn out – of course, we will see, but trade wars very rarely lead to positive mutual results.” – writing Getmantsev Telegram.

Potential windows of opportunity: will Ukraine be able to take advantage of the situation

Despite the threat, some Ukrainian experts see opportunities in this situation. If the countries of the EU, China, India, South Korea and others face complications in supplying products to the USA, this may open up new niches for Ukraine. Theoretically, Ukrainian manufacturers can offer an alternative to certain types of raw materials, agricultural products or even components, if they manage to quickly adapt to the regulatory conditions of the American market. However, the realization of such opportunities will require a high level of diplomatic activity, a flexible customs policy, clear communication with business and the ability of the government to respond not reactively, but proactively.

At the same time, it is obvious that the very fact of Ukraine’s presence in the “10% group” can be a signal for strategic planning. This does not rule out renegotiations on individual commodity items, the creation of bilateral trade exceptions, or participation in deeper economic partnerships with the United States. The question remains open: will Ukraine simply be a country that has passed the worst conditions, or will it try to use the moment to turn the global trade crisis into a chance to review its presence in global chains.